How to Get the Most Out of the Savings Goal & Budget Features

Does your New Year’s resolution involve doing a better job with your finances? If it does, the Savings Goal and Budget features within Connexus Digital Banking can help you. Those two features have been incredibly helpful for me, so I’m going to show you how I use them.

How I Use the Budgets Feature

To get started, just open the Budgets feature from the menu and create a name for your budget. I used “Monthly Expenses” as the name for mine.

Next, I added my family’s income. My wife and I each get paid biweekly on Friday, so I expect us to get at least four paychecks each month. Then I added our regular monthly expenses:

Regular Monthly Expenses

(Category: Sub-Category)

• Auto & Transport: Auto Payment

• Auto & Transport: Insurance

• Auto & Transport: Gas & Fuel

• Bills & Utilities: Internet

• Bills & Utilities: Mobile Phone

• Bills & Utilities: Gas & Electric

• Education: Student Loan

• Food & Dining: Groceries

• Home: Mortgage & Rent

• Kids: Baby Sitter & Daycare

After a few weeks, I found some discretionary expenses (restaurants, entertainment, etc.) warranted new budget categories and sub-categories. I moved those expenses into my budget to help me reel in that spending.

Additional Discretionary Expenses

• Food & Dining: Restaurants

• Home: Home Improvements

• Gifts & Donations

For additional help, I enabled two Account Notifications. Now I get a text whenever a budget category was exceeded and I receive regular text updates on my progress. How to set up Account Notifications.

How I Use the Savings Goals Feature

Last week Facebook Memories reminded me I haven’t been on vacation for eight years. Saving money doesn’t come easy to me, and with four kids there always seems to be unexpected spending. To help me save, I created a goal.

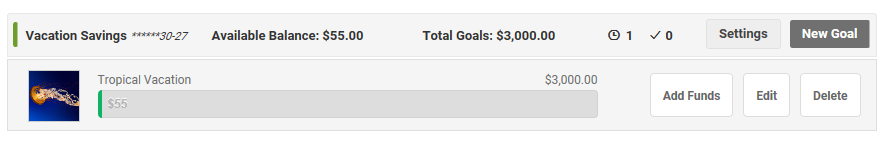

I started by opening another Savings Account and calling it “Vacation Savings.” Then I opened the Savings Goal feature within Digital Banking, created a New Goal for my new account, and set my target at $3,000.

For me to be successful, I have to make saving automatic. So I scheduled automatic transfers each week on Saturday to move money from my checking account to my Vacation Savings. My $50.00 weekly automatic transfers should get me pretty close.

Again, I enabled some Account Notifications to help me out. I set it up so I get a push notification sent to my phone when I complete my goal or when I’m in danger of missing it.

Like I said, these features help me out a lot, and I know they’ll help you too. If you have any questions about setting up a budget or savings goal, check out the Help section within each feature to find video tutorials and step-by-step instructions.

Good luck with your New Year’s resolutions!