Auto Loans

Your loan. Your budget.

Find the rate, term, and monthly payment that works for you.

Questions? Let’s talk.

Benefits for you

Our Auto Loan benefits

Competitive rates

Today’s Auto Loan rates

Competitive rates

Today’s Auto Loan rates

| Model Year | Term | APR1 As Low As | Monthly Payment |

|---|---|---|---|

| 2022 or newer | 24 months | 6.99% | $671.52 |

| 36 months | 6.19% | $457.62 | |

| 48 months | 6.39% | $354.96 | |

| 60 months | 6.50% | $293.49 | |

| 72 months | 6.89% | $254.94 | |

| 84 months | 7.69% | $231.48 | |

| 2021 and older2 | 24 months | 6.29% | $666.77 |

| 36 months | 6.44% | $459.33 | |

| 48 months | 6.69% | $357.04 | |

| 60 months | 6.94% | $296.59 | |

| 72 months | 7.49% | $259.28 | |

| 84 months | 8.24% | $235.59 | |

| Accurate as of 10/27/2025 | |||

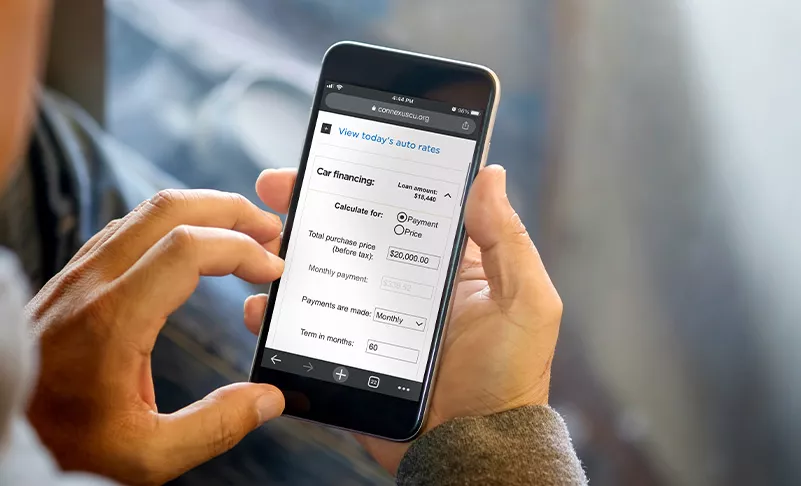

Calculator

- Calculate Auto Loan payment Find out how much vehicle you can afford and your monthly Auto Loan payment with our easy-to-use calculator.

simple financing steps

Auto Loan process

available coverage

Protect your vehicle

Choose comprehensive coverage options, such as Debt Protection, GAP Protection, and our Warranty Program, to safeguard your investment and give yourself peace of mind for the road ahead.

blog

Learn more about car buying

Auto Loan Pre-Qualification and Pre-Approval: What’s The Difference?

Gearing up for a new ride? Learn the difference between being pre-qualified and pre-approved for an Auto Loan.

10 Common Mistakes Car Buyers Make

Buying a new vehicle is exciting, but it’s easy to overpay if the excitement clouds your judgment. Here are ten common mistakes car buyers make and tips to help avoid them.

Why Get Financing BEFORE You Buy a Vehicle

If you want your dealership experience to be as smooth as possible, get your financing first. Here’s why.

FAQs: You asked. We answered.

Auto Loans

Disclosures

See our Fee Schedule for a list of fees you may encounter.

* Calculated based on the difference between the amount paid in interest between Connexus Credit Union’s rate at 5.390% APR compared to 6.707% APR for the National market average over the life of a $30,000 auto loan over 60 months. Accurate as of: 10/26/2025. Source: Datatrac

- APR = Annual Percentage Rate. All rates accurate as of 10/27/2025 and are subject to change. Rates include a 1% discount when registered for Digital Banking and subscribed to eStatements, and a 1% discount for auto-paying electronically. Loan term must be at least 24 months. Individual rates and terms may vary and include all eligible discounts. Certain restrictions apply. Offer does not apply to loans currently financed at Connexus Credit Union. Offer subject to change or termination.

- To be eligible for the lowest available rate, term length restrictions apply. Model years 2021-2022 have a maximum term of 84 months. Model years 2018-2020 have a maximum term of 72 months. Model years 2017 and older have a maximum term length of 60 months.

- Make no auto loan payments for up to 90 days upon request. Offer does not apply to auto loans currently financed at Connexus Credit Union. Deferred payments must be requested at the time of application, may not exceed 90 days, and are subject to credit approval. Interest begins accruing upon disbursal of loan. Some restrictions may apply.