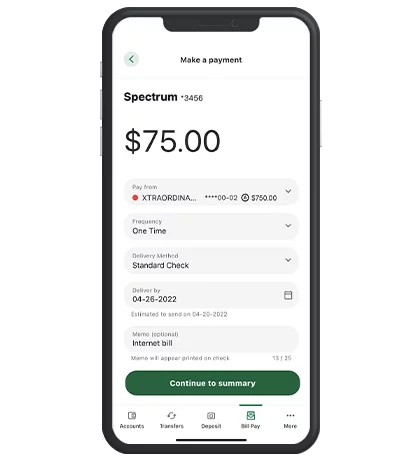

Bill Pay

Pay your bills online through Digital Banking.

Set it. Forget it. And never miss a payment again.

With Bill Pay, you can pay a bill online once, or schedule recurring payments for the amount and frequency of your choice. No more check-writing, postage stamps, or missed payments. Just the ease and convenience of paying online.

How to set up payments

Step 1

Log in to Digital Banking on a computer. Under the Transfers & Payments menu, click “Bill Pay.” If it’s your first time using Bill Pay, you may be asked to select and answer three challenging phrases.

Step 2

Once Bill Pay is open, click “Add a Payee” and choose whether you’re paying a company, person, bank or credit union. Then click “Next.”

Step 3

Enter the requested information about your payee and click “Next.”

Step 4

Enter the remaining payee information and select which account you want your payment to come from. Then click “Next.”

Step 5

You will see your new payee in your list of Payments. Click on the payee name. Then choose the amount and payment date. You can also choose to make it a recurring payment.

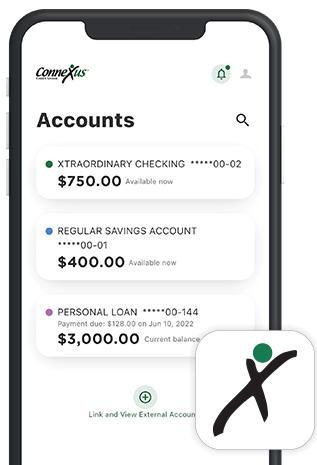

Take Connexus on the go

Download the Connexus App1 on your phone or tablet!

FAQs: You asked. We answered.

Digital Banking: Bill Pay

Disclosures

- Connexus Mobile app is available for Apple® or Android™ mobile devices. Message and data rates apply. Apple® and the Apple® logo are trademarks of Apple® Inc., registered in the U.S. and other countries. App Store® is a service mark of Apple® Inc. Android™ and Google Play™ are trademarks of Google™ Inc.